Non convertible debentures ( NCD ) are fixed-income instruments, usually issued by high-rated companies. They offer higher interest rate than convertible debentures.

This article covers the following:

1. Non Convertible Debentures (NCDs)?

Investors are forever on the lookout for improved and more sustainable schemes. The market volatility, sometimes, even makes traditional and trusted investments lose their sheen. Here, Non Convertible Debenture or NCD proved to be a dark horse when they started delivering smaller but steady returns over time.

Like traditional corporate FDs, NCD too is a fixed-income investment with a specific term and interest income. Companies issue them to raise funds, and evidently you cannot convert it to equities. To make up for this limitation, investors enjoy supreme returns, liquidity, low risk and tax respite as opposed to convertible debentures.

2. Features of NCDs

a. Issuance

Companies provide NCDs through open issues, which the potential investors can buy within specific periods. There are options to buy NCDs from stock markets.

b. Credit rating

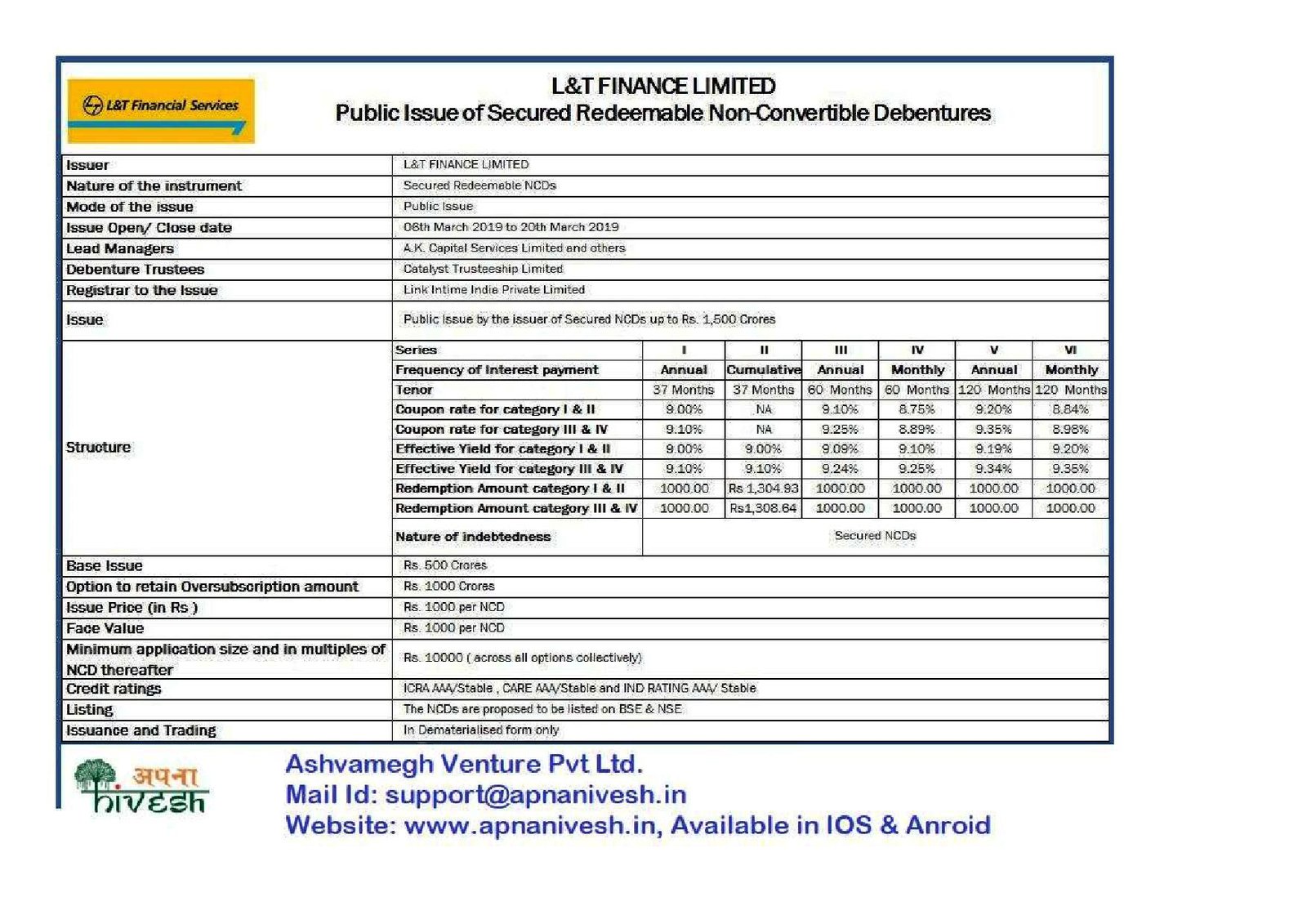

Only companies with good credit rating can have the authorization to issue NCDs. Credit rating agencies also rate NCDs itself. Ratings are subject to revisions regularly.

c. Interest

The higher credit rating an NCD has, the lesser interest it offers. Almost every NCD promises dual earning potential – growth-based and interest-based or cumulative opportunities.

d. Return rates

Usually, NCDs give you higher returns (10%-11%), compared to corporate FDs, bank FDs and Government bonds (max 8%).

3. Things an investor should consider

NCDs are vulnerable to risks related to handling the business and funding. If the turnover is negatively impacted, the credit rating might go down as the company borrows more and more from banks or NBFCs. So, do consider the below factors before choosing a company or NCD.

a. Credit Rating of the issuer

Select the company with AA rating and above. Credit rating calculates the firm’s potential to raise cash from its internal and external operations and its sustainability. This is the best parameter that can reveal the financial position of the company.

b. Level of Debts

Some background check on the asset quality of the company can go a long way for NCD investors. Do not invest if the company allocates more than 50% of their total assets towards unsecured loans.

c. Capital Adequacy Ratio (CAR)

CAR gauges the company capital and see if the company has sufficient funds to survive potential losses. Check if the firm you plan to invest in has at least 15% CAR and have historically maintained the same.

d. Provisions for Non Performing Assets

The company must keep aside at least 50% of their assets towards NPAs as this is a positive indicator of their asset quality. If the quality drops due to bad debts, take it as a red flag.

e. Interest Coverage Ratio

The Interest Coverage Ratio or ICR determines if the firm can comfortably settle the interest on its loans at any given time. This ensures that the company can handle possible evasions.

f. Your tax slab

Investors in the 10% and 20% tax slabs find NCDs lucrative. This is because you can earn more if your tax bracket is low.

4. Difference between Corporate FDs and NCDs

It would be highly beneficial to know the difference between corporate fixed deposits and NCDs as given in the following table:

|

Corporate Fixed Deposits |

NCDs |

|

Unsecured against the assets of the bank or corporate |

NCDs is either secured or not secured against the company assets |

|

Exit route (especially early withdrawal) is difficult as it is often at the discretion of the company |

|

|

Interest earned (if more than Rs. 10,000) on corporate deposits has TDS |

No TDS for registered NCDs |

|

Deposit Insurance and Credit Guarantee Corporation insures bank FDs (up to Rs. 1 lakh). |

NCDs are not insured, but are secured against the company assets |

|

While you cannot sell FD in market, FDs enjoy more liquidity than NCDs |

You can trade your NCD, but not withdraw it prematurely |

|

No interest risk |

Interest varies as per market |

5. Types of NDCs

NCDs are of 2 kinds – secured and unsecured. Choose a secured one as it comes with a host of benefits aside from being protected against the company assets. Even if the company closes, you will get your dues.

6. Tips for investing in NCDs

a. Organizations resort to raising funds using NCDs only to meet a specific business purpose. Read the terms and conditions – if they do not offer you clarity on how/where your money is going to be used, do not invest.

b. Due to NCD’s non-liquid nature, start small or use money you may not need until the plan matures.

c. Diversification i.e. investing across various firms and periods can reduce the risks considerably.

d. NCDs from one single sector (NBFCS that focuses on personal loans) are not safe to invest in. This can lead to higher risk exposure.

e. NCDs from the secondary markets have always delivered higher returns in the past. This is when you buy older NCDs when a firm issues a new one.

f. Never go by the interest rate alone. It will not matter if the NCD yield (that decides your real returns) remains low.

g. The perfect time to sell your NCD is when its interest is due. This is because that’s premium trading time for a non convertible debenture. You will make more money out of it.