Why Choose a Apnanivesh?

We at ApnaNivesh ponder over this fundamental question every now and then. Why should an individual or a family trust their hard earned savings in the hands of an entity or an individual? This is all the more relevant today as Investors can invest directly and save a part of their expense. In our close interaction with various individuals, from our family of over 17000 investors, this is what we figured out : Investors are looking for ‘ An honest advice’. While investing, investors need to be ‘educated on investments’. Investors expect financial advisor to know the importance of savings and investment in middle class families. Investors have little or no idea about financial objectives/goals, retirement planning, long term compounding, inflation, risk or adjusted return. They expect the financial advisor to educate them and factor all this (and more) in the investment plan.

200+ Cr.

AUM in Cr

17000

Client Network

53

All Major AMCs

Technology Support

Marketing Support

Research Support

How is Apnanivesh Different?

We take pride in calling ourselves “advisors to middle class Indians”. We are extremely conservative in our approach to investments. We know perfectly well that our 90% of retail investors lose money in stock markets. In last 13 years not a single investor has lost money investing through us. We take an extremely calibrated approach to investing. We will look at several subjective & objective parameters before recommending a scheme or a product Following are five factors that are looked at before recommending debt or equity scheme: Age of the investor and risk appetite - Higher the Age, lower the risk and vice versa . Number of members in the family and number of dependents - Generally higher the family income, higher the risk appetite. However, this is to be combined with certain other variables and looked at on a case to case basis. Market conditions and interest rates - PE , P/BV, and dividend yields are the variables help us decide in 'favour of' or 'against equity'. Political Global Factors - Political stability, geopolitics, international oil prices and domestic and international interest rates are given adequate weightage.

Update on New Product

Update on New Product

Goal Based Investing

Goal Based Investing

Regular Monitoring of Investment

Regular Monitoring of Investment

Service on Call

Service on Call

Buy and Sell Online

Buy and Sell Online

Deal in Fianacial Services

Deal in Fianacial Services

How to Get Rich by Investing in Mutual Funds

Equity Mutual Fundsare essentially vehicles which hold ‘shares’ (or part ownership) of various companies.Retail investors view mutual fundsas a ‘black box’. This “black box” is viewed with lot of scepticism and negativity. A layman would think mutual funds has a price (NAV) that may go up and down. Mostly down. Fear of losing money will keep investors at bay. As a result, total head count of investors in the Indian Mutual Fund space is barely 2 Cr. A penetration of less than 2%.

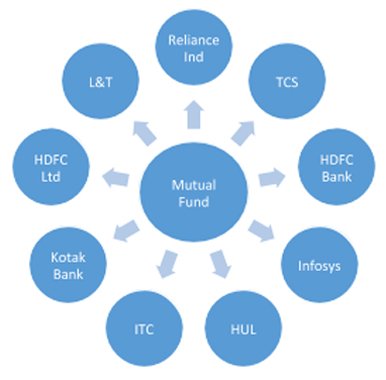

What are Mutual Funds, and more importantly how do they work? Equity Mutual Funds (or Equity oriented Mutual Funds) are essentially vehicles which hold ‘Equity shares’ of various companies. As we know the ‘shares’ of these companies are listed (and traded) on various stock exchange, such as BSE or NSE. When you buy a unit of the mutual fund, the investors’ money is used to buy parts of these companies. The following illustration shows a Mutual Fund with the Top 10 listed companies. In India 80% of all equity mutual fund assets are spread across around 150 companies.